2967 Views

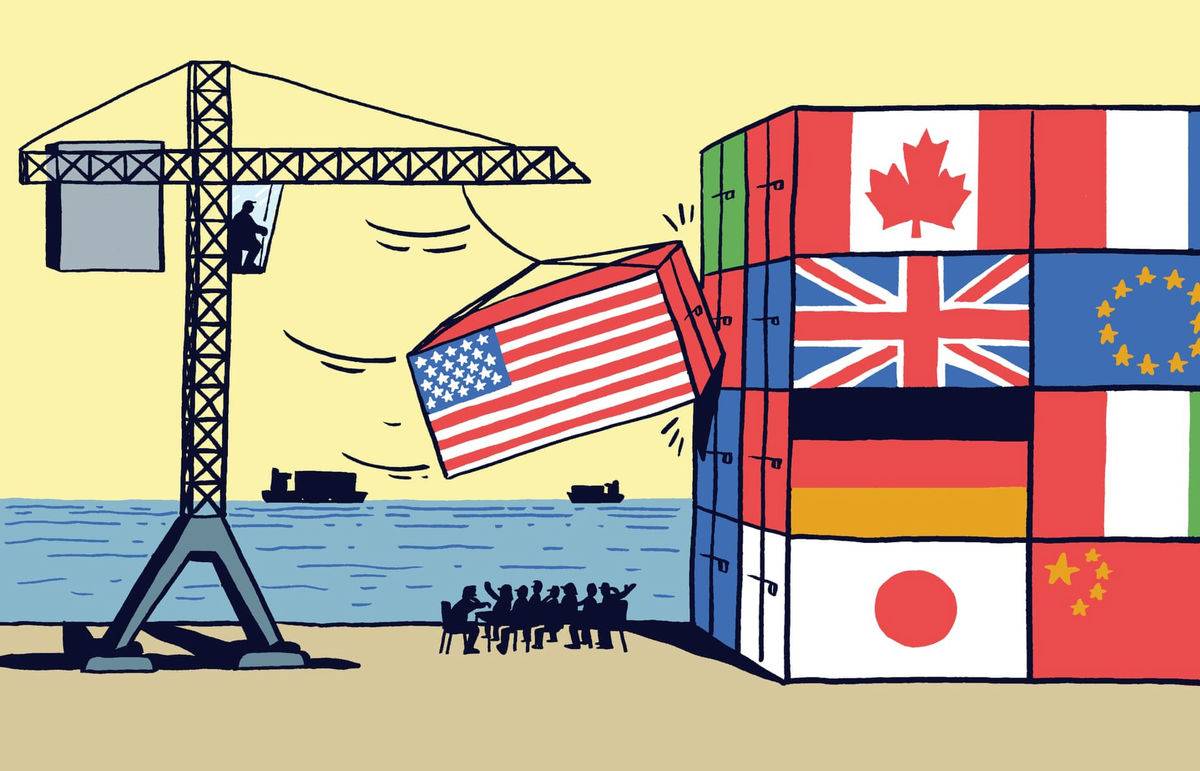

The End of the ‘Special Relationship’? How Trump’s Trade War Is Squeezing Post-Brexit Britain

The path of British exports to the United States has been on a downward trend in recent years, reflecting both broader global economic shifts and the direct impact of former President Donald Trump’s tariff policies. With Trump’s return to the White House in January 2025, a new tariff regime was introduced, including a 10% levy on imports from the UK, with even higher rates imposed on certain goods such as steel and automobiles.

These policies, promoted under the slogan “America First,” have sharply reduced British exports and exposed the vulnerabilities of the post-Brexit economy. Official data from the Office for National Statistics (ONS) in June 2025 shows that UK exports to the US dropped to £3.9 billion—the lowest level since February 2022. This decline has not only strained bilateral trade relations but has also raised questions about the future of post-Brexit economic ties, particularly as recent trade talks suggest Washington is prioritizing its own gains.

The downturn in British exports to the US has been both sharp and sustained over the past three years. In June 2025 alone, exports fell by £0.7 billion (14.5%) compared to May, hitting their lowest point in more than three years. On a quarterly scale, Q2 2025 saw a decline of £4.7 billion (13.5%) year-on-year, with particularly steep drops in chemicals and transport machinery.

The United States remains the UK’s largest single-country export market, with key sectors including machinery, automobiles, aerospace, pharmaceuticals, and financial services. However, this structural decline underscores ongoing pressures on the British economy and cannot be dismissed as a temporary fluctuation. Even within Buckingham Palace, the gravity of the situation has not gone unnoticed.

The impact has been most severe in manufacturing industries dependent on global supply chains, such as automotive and aerospace, since tariffs have directly targeted high value-added goods. For British firms, the downturn has meant falling revenues, reduced investment, job cuts, and weakened competitiveness. Meanwhile, rivals such as Germany and Japan have maintained their appeal in the US market, as UK factories report their steepest drop in export orders in five years.

At the center of this decline are Trump’s protectionist policies. Since April 2025, tariffs of 10% have been applied to UK imports, with rates of 25% on steel and higher tariffs on cars. These measures, designed to shield American industries, raised the cost of British goods in the US and eroded their competitiveness. In April, UK exports recorded a staggering £2 billion (33%) fall—the steepest monthly decline since 1997.

The repercussions extend beyond targeted industries. Supply chain disruptions increased costs, while the volatility of US trade policy has unnerved investors. Several companies, including Jaguar Land Rover, have halted exports to the US, putting thousands of jobs at risk. As a result, many firms are shifting focus toward Asian markets or even back toward the EU. This decline has also weakened the UK’s bargaining position ahead of key trade negotiations. London had hoped for a comprehensive post-Brexit Free Trade Agreement (FTA), but the export slump has undermined its leverage.

In May 2025, the “Economic Prosperity Agreement” was signed, reducing tariffs on cars, steel, and aluminum, and came into effect in June. However, given the ongoing tariffs, British negotiators have faced major challenges in securing exemptions and may be forced to offer concessions in areas such as agriculture or regulatory standards. Without swift solutions, the UK’s trade deficit will deepen—potentially triggering political costs in the upcoming elections.

Economically, the downturn has dealt a blow to Britain’s foreign trade strategy, which was crucial for offsetting Brexit losses. The UK economy contracted by 0.3% in April 2025, partly due to falling exports and the US tariff regime. Other effects include reduced production, job losses, and supply chain pressures. These developments highlight the risks of overdependence on the US market and the urgent need for diversification toward Asia or deeper reintegration with the EU.

Politically, the trend complicates transatlantic relations. The so-called “special relationship,” built on trade, defense, and shared values, is under strain. Tariffs have heightened tensions within NATO and global security frameworks, which could spill over into diplomacy and push Britain toward closer alignment with Europe.

The global consequences of this instability include market volatility and retaliatory measures. JP Morgan forecasts slower global growth in 2025, though the new trade agreement may mitigate some effects.

The decline in UK exports to the US is more than just a set of statistics; it reveals the strategic vulnerabilities of London’s trade strategy. Britain needs continued engagement with the US to maintain its global standing, but if the decline persists, it could pose a serious long-term challenge. London must balance pragmatism and flexibility in its relations with Washington, or else the “special relationship” may lose its relevance in an increasingly competitive and shifting global order. Trump’s unpredictable stance toward European allies only complicates matters, paving the way for the UK to gradually distance itself from the US.

In this context, the drop in exports serves as a serious warning: Britain must manage its relationship with the US pragmatically, or risk seeing the “special relationship” erode in the face of a rapidly changing world.

Translated by Ashraf Hemmati from the original Persian article written by Amin Mahdavi

Comment

Post a comment for this article