Biden Administration Prevails as Court Allows Implementation of Student Loan Repayment Plan

In a pivotal legal victory for the Biden administration, the U.S. Court of Appeals for the 10th Circuit has cleared the way for the Department of Education to proceed with its Student Aid Verification for Equity (SAVE) Plan. This decision marks a significant turn in the ongoing legal battles surrounding the administration's efforts to reform student loan repayment.

Initially launched last August, the SAVE Plan aims to provide relief to millions of borrowers by reducing their monthly payments under income-driven repayment structures. The plan had faced legal challenges from Republican-led lawsuits in states like Kansas and Missouri, which argued that the administration exceeded its authority in implementing these changes.

The recent appellate court ruling overrides previous injunctions that had temporarily halted the plan's rollout, particularly blocking the reduction of borrowers' payments from 10% to 5% of discretionary income for those with undergraduate loans. This adjustment, set to take effect in July, is expected to benefit approximately 8 million borrowers, providing them with more manageable repayment terms.

Secretary of Education Miguel Cardona highlighted the significance of the SAVE Plan, describing it as "the most affordable repayment plan in history" and emphasizing its role in shielding borrowers from accruing unpaid interest, a costly burden for many. Notably, over 4.5 million borrowers enrolled in the SAVE Plan are eligible for zero-dollar monthly payments due to their income levels.

The Department of Education, in response to the court's decision, is now moving swiftly to implement the revised payment schedules. Borrowers affected by the recent legal maneuvers will receive guidance from loan servicers on adjustments to their repayment obligations, ensuring they are aware of the changes slated to begin in August.

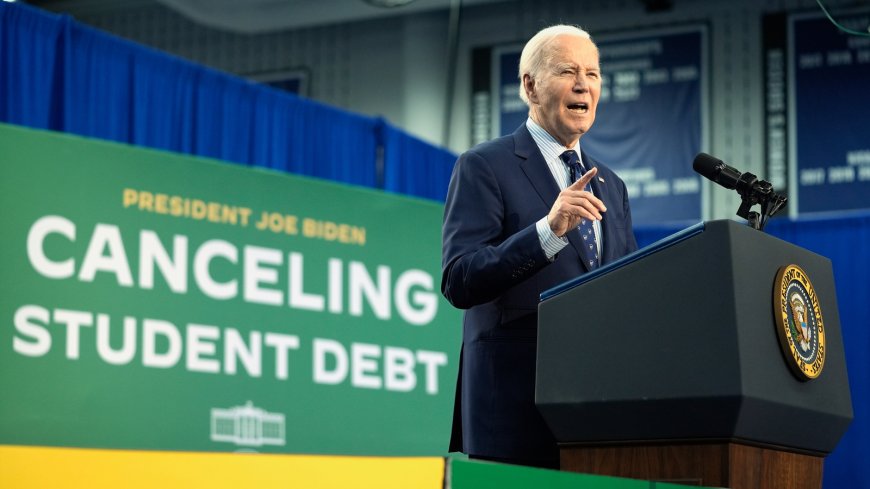

Despite this victory, the Biden administration continues to navigate a complex landscape of legal challenges and public expectations regarding student loan debt. Efforts to provide broader debt relief, including through mechanisms like Public Service Loan Forgiveness and targeted loan cancellations, remain a cornerstone of President Biden's policy agenda.

Looking ahead, the administration aims to expand its initiatives to alleviate student debt burdens, albeit with an awareness of the legal uncertainties that have characterized recent judicial rulings. As debates over student loan reform persist, stakeholders across the political spectrum are closely watching the outcomes of these legal battles, which carry profound implications for millions of borrowers nationwide.