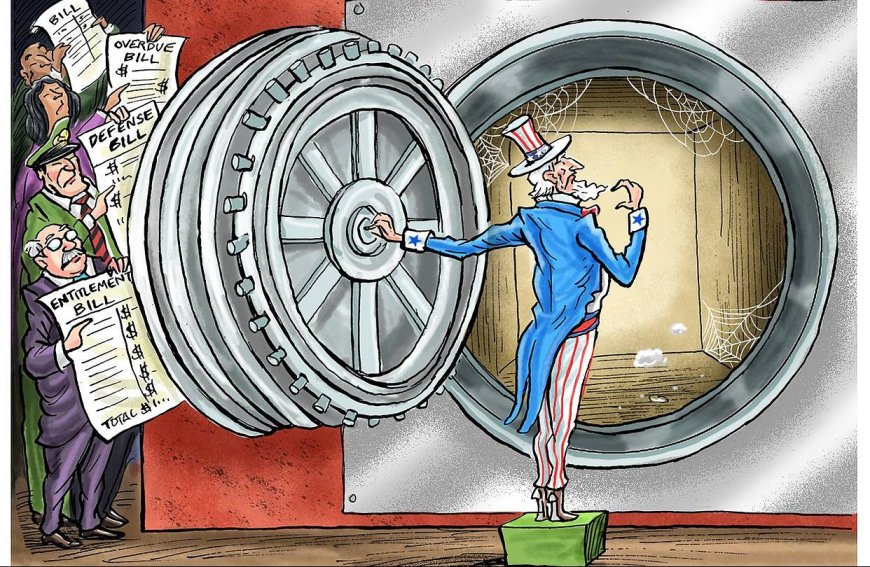

Why the United States is $31 Trillion in Debt?

By: S. Qurbani

The nonpartisan Congressional Budget Office (CBO) projections released last Wednesday indicate that expected interest rate hikes and the expensive plans of the two US political parties have increased the country's fiscal deficit.

The CBO predicts that the US will add roughly $19 trillion to its national debt over the next decade, a $3 trillion increase from previous projections.

In 2023, the federal government will spend $1.4 trillion more than it collects in tax income, according to the most recent projections. Due to the failure of tax collections to keep pace with the rising expenses of delivering social security and health insurance to citizens born after World War II who have now reached retirement age, budget deficits will exceed $2 trillion annually over the next decade.

To the chagrin of Americans, the whole public debt will equal the entire yearly output of the US economy in 2024, and will reach 118% of GDP by 2033.

According to the Independent Budget Office (IBO), the US economy will barely grow this year after accounting for inflation, as the unemployment rate will top 5%. America's faltering economy is mainly attributed to the Federal Reserve's endeavors to curb inflation by increasing interest rates, say economists.

The US national debt has climbed to over 31 trillion dollars since lawmakers have chosen to disregard economic realities, according to the Washington Post. Since World War II, the national debt has hit its highest level compared to the volume of the overall US economy. If nothing changes, the United States will face an uncertain future that jeopardises its national security, risks future investments, unjustly burdens future generations, and forces budget cutbacks to vital initiatives like social security. This becoming a reality is something nobody desires.

According to the CBO, the national debt is presently 98 percent of GDP and is forecast to reach 118 percent within a decade, mostly owing to increasing interest payments and pension expenditures. A PhD in accounting is not needed to discern the red flag here. When debt exceeds GDP, interest payments increase, leaving less for other investments. Moreover, by 2033, more resources will have been spent on debt repayment than on defence.

The United States' national debt of $31.4 trillion is the direct result of disastrous political decisions and economic shocks around the turn of the century. Prior to this, the federal government spent less than it collected in taxes, and the debt limit was not an issue. Former presidents George W. Bush, Barack Obama, and Donald Trump all favoured revenue-reducing tax cuts. The tremendous expenses of the Bush administration's catastrophic wars in Iraq and Afghanistan were not covered by tax increases. Obama, Trump, and Biden, however, approved legislation granting billions of dollars in emergency funding to tackle the 2008 financial crisis and the persistent recession driven on by the COVID-19 pandemic in 2020.

The budget-to-GDP ratio of the United States from 1903 to 2023, together with its estimates until 2053, illustrates the country's dismal economic growth trajectory.