Bloomberg: The tightening of oil sanctions against Iran poses economic and electoral risks for Biden

According to Bloomberg writes that the White House is discussing the issue of tightening anti-Iranian sanctions, at the same time realizing that any wrong step can destabilize the global oil market.

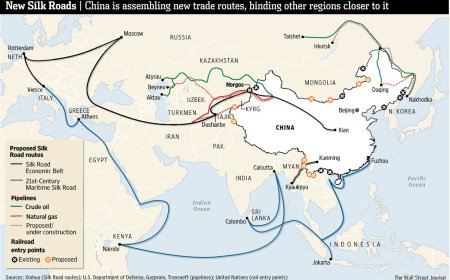

The Biden government should be able to convince the major oil producers, including Saudi Arabia, to prevent the increase in oil prices. In 2022, Saudi Arabia rejected a similar request by Biden, and recently it was leading the list of countries that reduced oil production in OPEC. In addition, China, which is the main buyer of Iranian oil and the biggest competitor of the USA, has no desire to help Washington. A group of US bipartisan lawmakers called on the government to tighten the sanctions imposed on Iran in the oil sector. However, this will contribute to the increase in the price of oil, which will become a serious problem for Biden ahead of the elections to be held in November. Bloomberg's source noted that the White House is discussing the issue of imposing sanctions on Iranian crude oil ships and the countries involved in that process. The newspaper writes that while the US focused on reducing Russia's energy revenues, Iran increased its oil exports.

The Japanese Nikkei newspaper wrote in its article that in 2023, Iran's oil exports will increase by 50 percent to 1.3 million barrels per day. The Japanese newspaper Nikkei wrote in its article today, Wednesday, that Iran's crude oil exports increased by almost 50% last year and reached the highest level in the last five years, which is about 1.3 million barrels per day. Most of Iran's oil exports went to China this year. According to this article, the International Energy Agency reported that Iran would produce 2.99 million barrels of oil per day in 2023, which is 440,000 barrels more than in 2022. China's demand has prompted Iran to increase production. Data from the European Kepler research company show that almost 90% of Iran's crude oil exports go to China. According to Reuters, more than 40 small and medium-sized independent Chinese oil refineries buy Iranian oil mainly in yuan. According to this report, ships carrying Iranian oil use methods such as moving from ship to ship at sea and concealing information about their location to evade US sanctions.