The Illusion of European Victory: How the Continent's Energy Gambit May Backfire

By: A. Mahdavi

In the complex and often turbulent arena of international politics, Europe’s attempt to penalize Russia through sweeping sanctions, particularly in the energy sector, has been portrayed as a strategic masterstroke. Western leaders and pundits alike have celebrated the embargoes on Russian gas as both a moral stand and an economic pressure point that would supposedly cripple Russia’s economy while paving the way for a brighter, more autonomous European future. But as the dust settles, one must ask: has Europe truly emerged as the victor in this grand geopolitical chess match, or is it setting itself up for a long-term defeat?

The narrative that Europe has successfully weaned itself off Russian gas is, at best, a precarious one. It is true that European countries, driven by both moral outrage and geopolitical pressure, have significantly reduced their dependency on Russian gas. This reduction, however, has come at a steep price, both economically and strategically.

A Pyrrhic Victory?

European leaders have often touted the diversification of energy sources as a victory. The pivot from Russian gas to liquefied natural gas (LNG) from the United States, as well as other sources like Qatar, has been heralded as a triumph of Western unity and resilience. Yet, this newfound “independence” is illusory. The shift to LNG has imposed a heavy economic burden on European economies, with costs significantly higher than the relatively inexpensive pipeline gas from Russia.

Moreover, Europe’s energy security has not been strengthened by this move; it has merely shifted dependencies. Instead of relying on Russian pipelines, Europe now finds itself at the mercy of global LNG markets, where prices are volatile and supplies can be uncertain. In times of crisis, Europe could find itself outbid by larger and wealthier buyers, leaving it in an even more precarious position.

The Russian Response: Resilience and Reorientation

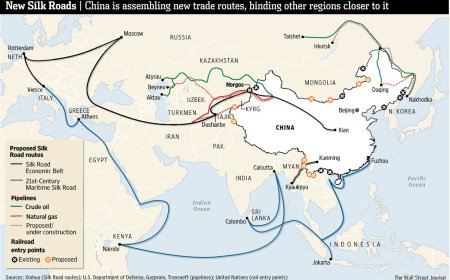

Contrary to Western expectations, Russia has not crumbled under the weight of sanctions. Instead, the Russian economy has shown remarkable resilience, adapting to the new reality with surprising agility. Russia has turned its gaze eastward, towards China and India—two of the world’s largest and most dynamic energy markets. These nations, eager to secure long-term energy supplies at favorable rates, have embraced Russia as a key partner, effectively neutralizing the impact of Europe’s sanctions.

China, in particular, has become a vital lifeline for Russia, offering not only a vast market for its energy exports but also a strategic partnership that strengthens both nations against Western economic pressures. As Russia solidifies its ties with these Asian giants, it is effectively laying the groundwork for a new global energy order—one in which Europe plays a diminished role.

The False Dawn of European Competitiveness

Proponents of the European strategy argue that the short-term pain of higher energy costs will be offset by long-term gains in energy independence and competitiveness. However, this optimistic outlook ignores the realities of global markets and the limitations of Europe’s economic model. The high cost of importing LNG, combined with Europe’s stringent environmental regulations and aging industrial base, threatens to erode the continent’s competitiveness on the global stage.

As energy prices remain high, European industries—already struggling with rising production costs—may find it increasingly difficult to compete with their counterparts in Asia and North America. The very sanctions that were intended to weaken Russia could end up weakening Europe instead, as companies relocate production to regions with cheaper energy and more favorable economic conditions.

The Strategic Misstep: Overreliance on the United States

Europe’s pivot to American LNG is not just an economic decision; it is a strategic one as well. By aligning itself so closely with U.S. energy interests, Europe risks becoming overly dependent on Washington—a dependency that could have serious geopolitical consequences. The United States, while a reliable partner, has its own strategic interests, which may not always align with those of Europe. In a world where global power dynamics are shifting rapidly, Europe’s overreliance on American energy could leave it vulnerable to shifts in U.S. foreign policy.

Moreover, Europe’s current strategy plays directly into the hands of American energy companies, which have long sought to expand their market share in Europe. By pushing Russian gas out of the market, Europe has effectively handed a significant portion of its energy sector over to American corporations, raising questions about the long-term implications for European sovereignty and economic independence.

Conclusion

As the conflict in Ukraine grinds on, it is becoming increasingly clear that Europe’s energy war with Russia is far from over. In the short term, Europe may claim victory—having reduced its reliance on Russian gas and inflicted economic pain on the Kremlin. But in the long term, this victory could prove to be pyrrhic. As Europe grapples with the economic fallout of its energy decisions, it may find itself weaker, less competitive, and more dependent on external powers than ever before.

The lesson of this conflict is clear: energy is not just a commodity; it is a strategic weapon. In its zeal to punish Russia, Europe may have underestimated the complexity of the global energy landscape and overestimated its own ability to navigate it. As the continent faces an uncertain future, it must reconsider its strategy—before it is too late. The road to energy independence is fraught with peril, and Europe may find that the price of victory is far higher than it ever anticipated.