The war in Ukraine and the worsening poverty rates in the UK

The war in Ukraine and the worsening poverty rates in the UK

By: F. Najafi

Amidst the global financial turmoil caused by the COVID-19 pandemic and the raging conflict in Ukraine, it is evident that all countries, including European countries, are grappling with the scourge of inflation.

However, recent surveys have revealed that the United Kingdom, in particular, is experiencing the most dire economic conditions across every indicator. The issue of destitution among British families is a pressing concern, especially when compared to other European nations. According to the latest rating by the International Monetary Fund (IMF), the British economy appears to be in a dire state when compared to other world economic powers and is projected to experience a contraction during the year 2023.

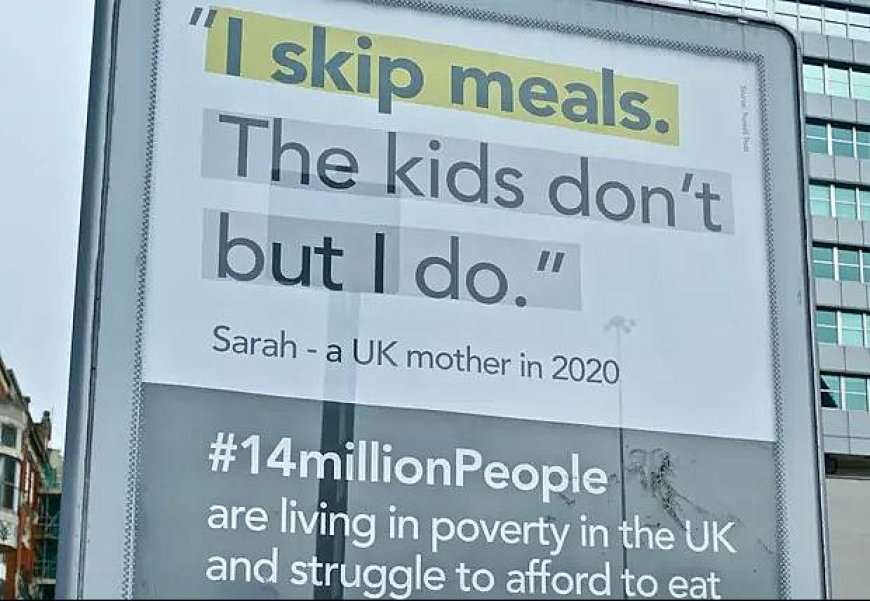

The inflation rate in the United Kingdom has caused quite a stir among investors and policymakers alike. With a jump from 2 to 10 percent, the UK is now the only country in Western Europe going through double-digit inflation. This development has certainly caught the attention of those in the field of politics. The latest official statistics reveal that energy prices have surged twofold over the past year, while food prices have experienced a staggering 80% hike. The recent announcement by a British think tank regarding the surge in food inflation has caused an uproar among the masses. This event has led to a significant increase in the annual cost of living for millions of households in the UK, thereby exacerbating the ongoing cost of living crisis. It is noteworthy that this is the highest level of food inflation since 2008.

The recent surge of 450 basis points in the interbank interest rate has had an immense effect on the monthly mortgage payments of millions of British citizens, leading to an enormous spike in their expenses. The British government has made a clear announcement that economic difficulties and obstacles will persist throughout the year. Furthermore, the government has reneged on its commitment to reduce inflation by fifty percent by year's end. The prevailing circumstances have resulted in catastrophic implications, notably the worsening of impoverishment in the United Kingdom. This has resulted in an extensive reliance on food banks by a considerable number of citizens who are striving to make ends meet with a meagre income. As claimed by the "Big Issue" newspaper, poverty in the United Kingdom has a longstanding history, with a significant number of households struggling with financial challenges.

As we observe the current state of affairs, it is evident that an enormous number of individuals have succumbed to poverty, with the brunt of the cost of living crisis being borne by families with small salaries. These latest figures from the UK government paint a stark picture of the poverty crisis in the United Kingdom, with an unbelievable 4.1 million citizens, or one in five people, living below the poverty line in 2022. The statistics also reveal that a concerning 2.4 million children are among those affected by this troubling scenario. As per The Guardian's report, the escalating cost of living has compelled women to resort to "survival sex" as a means of sustenance. According to various British charities, increasing costs and the government's prolonged neglect have forced women, even those dealing with mental health issues, to resort to sexual favours in exchange for basic necessities like housing. The widespread cost of living crisis has also had a profound impact on the psychological well-being of the British people.

The recently released FCA report sheds light on the fact that a staggering 28.4 million individuals experienced heightened levels of anxiety and stress in January 2023 as compared to six months before, owing to the current economic situation. The recent survey conducted by FCA showed that a significant proportion of the population, precisely 28%, has been deprived of a peaceful night's rest due to financial worries. The report illustrates the pressing need for effective measures to address the financial distress experienced by families across the nation. Moreover, there were those who were forced to dip into their hard-earned savings to keep themselves warm during the harsh winter months. As per the report, an alarming 11 percent of British citizens have decided to utterly ignore their financial letters of caution. The pressing question at hand is what the root cause of the deteriorating economic state in the UK is.

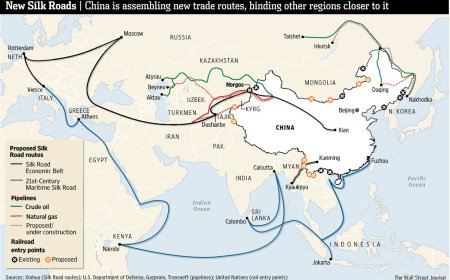

The current situation can be attributed to 10 Downing Street's involvement in the conflict in Ukraine. Amidst the ongoing protests and strikes across the UK, the British government remains steadfast in its support for the Ukrainian regime, despite the potential financial strain on British taxpayers. There are troubling reports that the UK is purportedly extending a loan of 500 million dollars to the regime in Kyiv. This latest loan marks a significant milestone in the ongoing support that Britain has extended to Ukraine since the start of the conflict, with the total aid package now surpassing 8.1 billion dollars. Also, at a time of severe economic hardship and social turmoil, the British government's decision to allocate a staggering sum of one hundred million pounds towards the extravagant coronation ceremony has been met with widespread criticism. Many observers have pointed out that this move only serves to highlight the stark class divide in the country, as the needs and livelihoods of ordinary citizens continue to be neglected.

As a result, protests and expressions of disappointment have been rampant in London and elsewhere. It is quite intriguing that the British Prime Minister, Rishi Sunak, has stated that the populace should not anticipate the government addressing their financial woes. Looking ahead, it appears that UK citizens will continue to face insurmountable economic challenges.