The End of Dollar Dominance: The Emergence of the Petro-yuan

The End of Dollar Dominance: The Emergence of the Petro-yuan

In the aftermath of World War II, the Bretton Woods conference saw the introduction of the US dollar as the world's primary reserve currency. This led to the fixing of gold at a tradable rate of $35 per ounce. Fast forward to 1974, during Nixon's presidency, and we witnessed US Secretary of State Henry Kissinger visiting King Faisal of Saudi Arabia to establish the oil revenue system based on the dollar.

Subsequently, the decision was made for the Organization of Petroleum Exporting Countries (OPEC) to employ the dollar in its global trade exchanges. This arrangement necessitated countries purchasing oil to acquire US dollars, thereby solidifying the dollar's prevalence in global trade. However, it appears that the era of dollar dominance may be drawing to a close.

At this year's World Economic Forum in Davos, Saudi Arabia's Finance Minister, Mohammad Al-Jadaan, made a rare announcement that the country is prepared to engage in trade utilizing currencies other than the US dollar. Consequently, signs of de-dollarization are becoming increasingly apparent. The Wall Street Journal reported that the United States is concerned about Saudi Arabia shifting the price of oil from dollars to yuan.

As a result, the US is actively working to dissuade the sale of Saudi oil in currencies other than the dollar. Behind the scenes of negotiations to normalize relations between Saudi Arabia and the Zionist regime, the US is attempting to convince Riyadh to continue pricing oil in dollars rather than Chinese yuan or alternative currencies. The US is pursuing a diplomatic agreement whereby Saudi Arabia agrees to normalize relations with the Zionist regime, and in return, Washington commits to safeguarding Riyadh and supporting the development of the country's nuclear program.

Although the focus of these negotiations ostensibly revolves around the Zionist regime and Palestine, the US is leveraging this agreement to exert pressure on Saudi Arabia, curbing its growing ties with China. Citing informed officials within the US government, The Wall Street Journal suggests that the Biden administration seeks assurances from Saudi Arabia that it will distance itself economically and militarily from China.

The bilateral relationship between China and Saudi Arabia extends beyond commercial activities, encompassing defense and other sectors over time. In late 2021, CNN reported that China was assisting Saudi Arabia in developing its own ballistic missile program. Additionally, China has sold drones to Saudi Arabia that the United States has refused to provide.

The Biden administration is also uneasy about the prospect of Saudi Arabia and China conducting oil trade in yuan, as such a development would lend significant momentum to the de-dollarization movement. The UAE's recent signing of its first yuan-denominated liquefied natural gas (LNG) contract with China further suggests that Saudi Arabia may accept yuan for oil sales.

Huawei, the world's largest telecommunications equipment manufacturer, is expanding its presence in Saudi Arabia and other Middle Eastern countries. The Trump administration had pressured the United Arab Emirates to distance itself from the Chinese multinational technology company. The Biden administration will continue its efforts to convince Saudi Arabia and other regional players to sever ties with Huawei. However, achieving success in this endeavor will prove challenging for the White House, given the significance of the Chinese tech giant to the broader goals of Saudi Arabia's Vision 2030.

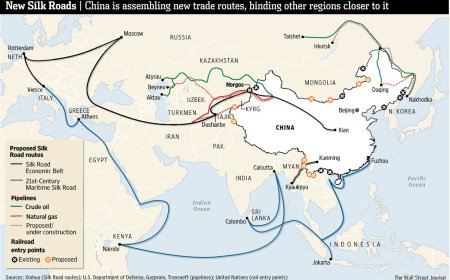

The economic relations between Beijing and Riyadh have experienced exponential growth in recent decades, with China emerging as Saudi Arabia's largest trading partner, accounting for 25% of its total oil exports. Saudi Arabia plays a pivotal role in China's Belt and Road Initiative, ranking first among the top three countries in the world for China's construction projects.

The Saudis support the use of the yuan as it allows them to pay Chinese contractors working on major projects in their own currency, reducing the risks associated with Beijing's capital controls. While yuan-denominated oil deals have been under negotiation since 2016, recent developments have lent momentum to these discussions, driven by growing Saudi concerns over Washington's commitment to their security and military interests.

During his visit to Riyadh last year, the Chinese president, Xi Jinping, proposed conducting energy trade between Beijing and the countries of the Persian Gulf Cooperation Council (PGCC) in yuan. In addition to guaranteeing yuan stability, China pledged to increase energy imports from these nations. The proposal received a warm welcome from the Arab countries of the Persian Gulf region, with Saudi authorities announcing their readiness to engage in trade using currencies other than the dollar. This event poses a significant threat to the dominance of the dollar, particularly within the energy market. China's strategy of employing its national currency in international trade aims to limit US influence.

Alongside agreements with its allies in "BRICS" and the Persian Gulf Cooperation Council, China has been accumulating large quantities of gold in recent years to provide strong backing for the yuan, in stark contrast to the dollar, which Beijing authorities argue has been printed without adequate support. China's use of the yuan in cross-border transactions has undergone a successful transformation, with zero percent of such payments and receipts in yuan in 2010, projected to reach 48 percent in 2022. Furthermore, China has significantly reduced its reliance on the dollar, from 83% of cross-border transactions in 2010 to a mere 47% in 2022.

This year witnessed the first energy transaction denominated in yuan between China and the United Arab Emirates. Beijing purchased 65,000 tons of LNG from Abu Dhabi, paying the price in yuan. This significant event serves as a foundation for future transactions.