Navigating the Maze: Borrowers Confront Complexities in Biden's Debt Relief Plans

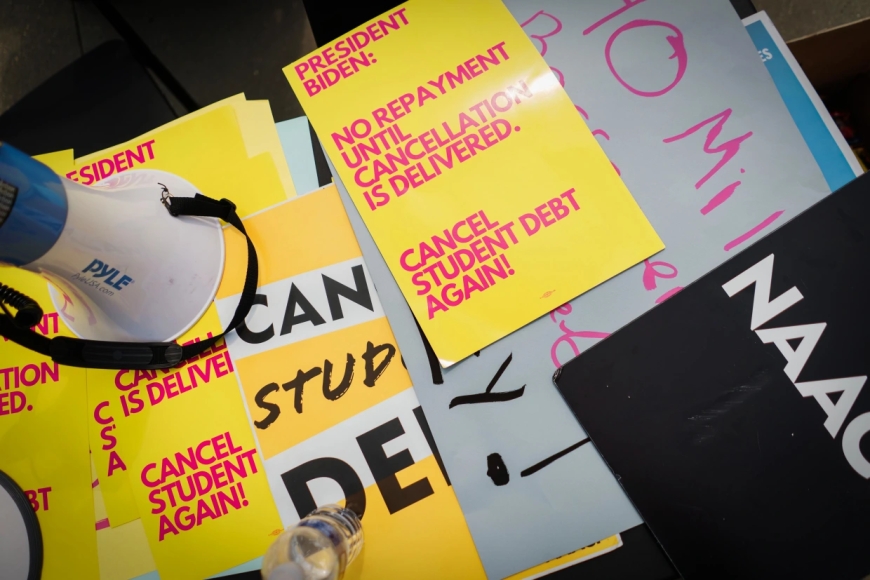

In the wake of a Supreme Court decision that struck down President Biden's comprehensive student loan forgiveness plan, millions of borrowers are grappling with a confusing array of debt relief options and resuming payments after the pandemic pause

In the wake of a Supreme Court decision that struck down President Biden's comprehensive student loan forgiveness plan, millions of borrowers are grappling with a confusing array of debt relief options and resuming payments after the pandemic pause. This turmoil was underscored by the high court's decision alongside its rulings on significant LGBTQ cases, reflecting a critical juncture in both civil rights and economic policy.

Rachel Grace, a 39-year-old marketing communications professional from Nebraska, faced a stark choice as student loan payments resumed last October: continue paying for health insurance or service her student loan debt. Choosing the latter, she has since lived under the cloud of potential health crises, a situation she describes as "scary."

The Biden administration, responding to the Supreme Court's rejection, has accelerated the implementation of numerous smaller-scale debt relief initiatives. These include enhancing forgiveness for public servants, addressing fraud in education, and expanding eligibility for disabled borrowers. This patchwork approach has led to significant relief for some but has also sown confusion among many trying to navigate the changes.

Betsy Mayotte, president of the Institute of Student Loan Advisors, emphasizes the mixed outcomes: "On one hand, we've seen borrowers relieved by these changes. On the other, the rapid rollout has led to misunderstandings and missteps along the way."

Despite these challenges, the effects of these programs are beginning to be felt. Last month, Biden introduced further plans intended to ease or eliminate student debt for millions by this fall, an effort detailed by an Education Department official.

Robert Farrington, a student loan advisor and editor-in-chief of The College Investor, highlights the complexities involved: "Borrowers are faced with a barrage of new programs, each with its intricacies. It's overwhelming, and many struggle to understand which options apply to them."

Amid this confusion, the Biden campaign is keen to showcase the tangible benefits of these debt relief efforts as part of its bid for re-election. Administration officials, including Biden himself, have been touring the country to promote these successes. In a notable instance, Biden's visit to a North Carolina school principal who had $90,000 in debt forgiven went viral on TikTok, illustrating the personal impact of these policies.

However, not all feedback is positive. A recent NBC News poll indicated only 44% approval of Biden's handling of student loans among registered voters, though this remains one of his stronger areas of support. A separate Harvard poll reflected lower approval among younger voters, at just 39%.

The campaign believes that more aggressive communication is needed to capture voter attention, especially as the election nears and contrasts with former President Trump's policies, which included attempts to cut funding for these relief programs.

As these programs continue to roll out, Rep. James Clyburn, a close Biden ally, anticipates that tens of thousands more borrowers will benefit from debt forgiveness before the election, providing a stark contrast to Trump's policies.

For borrowers like Rachel Grace, the relief can't come soon enough. She took on $40,000 in loans in 2003 and has struggled with debt ever since. The pandemic pause allowed her a respite, enabling her to build savings and improve her financial situation significantly. With her recent forgiveness under a Biden plan for long-term borrowers, Grace is finally able to prioritize her health again, planning to reinvest her freed-up funds into much-needed health insurance.

This evolving situation highlights the Biden administration's ongoing struggle to balance immediate economic relief with long-term policy goals amid judicial setbacks and political opposition.