Trump Vows to Halt De-dollarization, Threatens Trade Tariffs on Non-Dollar Transactions

During a recent campaign rally in Wisconsin, former U.S. President and 2024 presidential candidate Donald Trump issued a stern warning to countries seeking to reduce their reliance on the U.S. dollar. Acknowledging that de-dollarization efforts are gaining momentum globally, Trump promised that, if elected, he would take aggressive measures to maintain the dollar's status as the world's reserve currency.

According to a report by Russia Today, Trump admitted that the dollar is facing a "big blockade," with many countries shifting to other currencies for trade. In response, he proposed a radical solution: a 100% tariff on goods imported from nations that engage in bilateral trade outside the dollar system. This policy, he argued, would serve as a deterrent to countries moving away from the dollar and protect the U.S. economy.

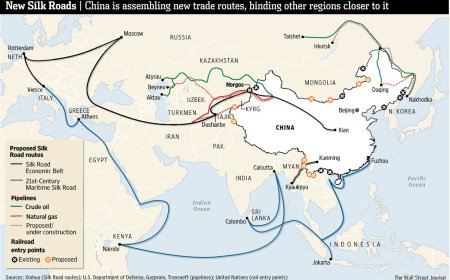

Rising Global De-dollarization Efforts

Trump's remarks come at a time when several major economies, including Russia, China, and Iran, have accelerated their efforts to reduce reliance on the dollar in international transactions. These countries, many of which have faced U.S. sanctions, have increasingly turned to their national currencies for trade. Russia and China, for instance, now conduct much of their bilateral trade in rubles and yuan, while Iran has embraced de-dollarization as a way to mitigate the impact of U.S. economic pressure.

The U.S. government's use of the dollar as a tool for sanctions has, in many cases, pushed nations toward alternative currencies. By weaponizing the dollar in this way, critics argue, the U.S. has unintentionally undermined the global financial system it has long dominated. Trump's proposed tariffs would further escalate tensions with nations pursuing independent trade policies.

Trump's Strategy to Protect Dollar Supremacy

During his rally, Trump emphasized the need to "reclaim the dollar’s status as the world's reserve currency," arguing that without it, the U.S. would face significant economic consequences. His proposed 100% customs duty on imports from countries transacting outside the dollar system represents a dramatic escalation of the trade policies he employed during his presidency, where tariffs were used as leverage in international negotiations.

While Trump's tough stance on trade is consistent with his "America First" platform, his plan to punish countries that abandon the dollar could provoke retaliatory measures and further accelerate de-dollarization trends. This aggressive approach might appeal to voters concerned about U.S. economic standing, but it could also lead to increased geopolitical tensions.

Global Economic Implications

The growing movement to bypass the dollar in trade reflects the broader trend of shifting global power dynamics. Countries like China and Russia, motivated by a desire to reduce their vulnerability to U.S. sanctions and increase financial independence, have spearheaded the de-dollarization effort. BRICS nations (Brazil, Russia, India, China, and South Africa) are even exploring the possibility of creating a digital currency to further reduce reliance on the dollar.

Critics argue that by continuing to use the dollar as a tool of economic warfare, the U.S. risks further alienating key global players. As the de-dollarization trend accelerates, the long-term viability of the dollar as the dominant reserve currency may be in jeopardy.

Trump’s vow to stop de-dollarization by imposing punitive tariffs on countries trading outside the dollar underscores the seriousness of the issue in the 2024 election. While his hardline stance resonates with certain segments of the electorate, it remains to be seen how effective such measures would be in reversing global de-dollarization efforts. For now, the debate over the future of the U.S. dollar and its role in international trade continues to intensify, as both geopolitical and economic forces push for a redefined global financial order.